Building Financial Foundations: Lessons From the Teen Wealth Workshop

Although our official homeschooling journey starts in the fall, this week I took my oldest son to a Teen Wealth Workshop to kickstart his education on topics not covered in 7th grade. He learned about assets, liabilities, active income, passive income, and so much more. Gaining this knowledge at such a young age will set him up for an incredible future. One of the reasons we decided to homeschool was to teach real-life skills that aren't typically covered in traditional schools, making this workshop a perfect fit.

The first day the kids were taught about handling finances, understanding good debt vs. bad debt, and learning about assets, liabilities, real estate, and investing, which was also a good reminder for the parents. In the afternoon session, we divided the kids into four sessions to learn about different career paths: tradesman, content creator, highly educated professional (doctor/lawyer), and entrepreneur.

These presentations prepared them for the second day of the conference where the kids participated in "The Game," where their mission was to achieve the highest net worth by selecting a career, buying assets and liabilities, and making investments in real estate, stocks, bonds, and index funds. We watched the kids grow their portfolios and become multi-millionaires in the span of 16 years, with the winner having a net worth of over 34 million, how’s that for motivation for the kids?!

Tips for Implementing Financial Lessons Learned at the Teen Wealth Workshop

Diversify with Index Funds

Spread your investments across a variety of assets to minimize risk.

Consider reputable options like Vanguard Funds for reliable returns.

Set Up Investment Accounts Early

Create custodial investment accounts for children to teach them the value of investing from a young age.

Start with small, manageable contributions and increase over time.

Utilize High Yield Money Market Savings Accounts

Opt for high yield money market accounts to earn better interest on your savings.

These accounts provide a safe place to grow your money with higher returns than traditional savings accounts.

Contribute to a Roth IRA

Take advantage of the tax benefits and long-term growth potential of a Roth IRA.

Encourage young earners to start contributing early for maximum benefit.

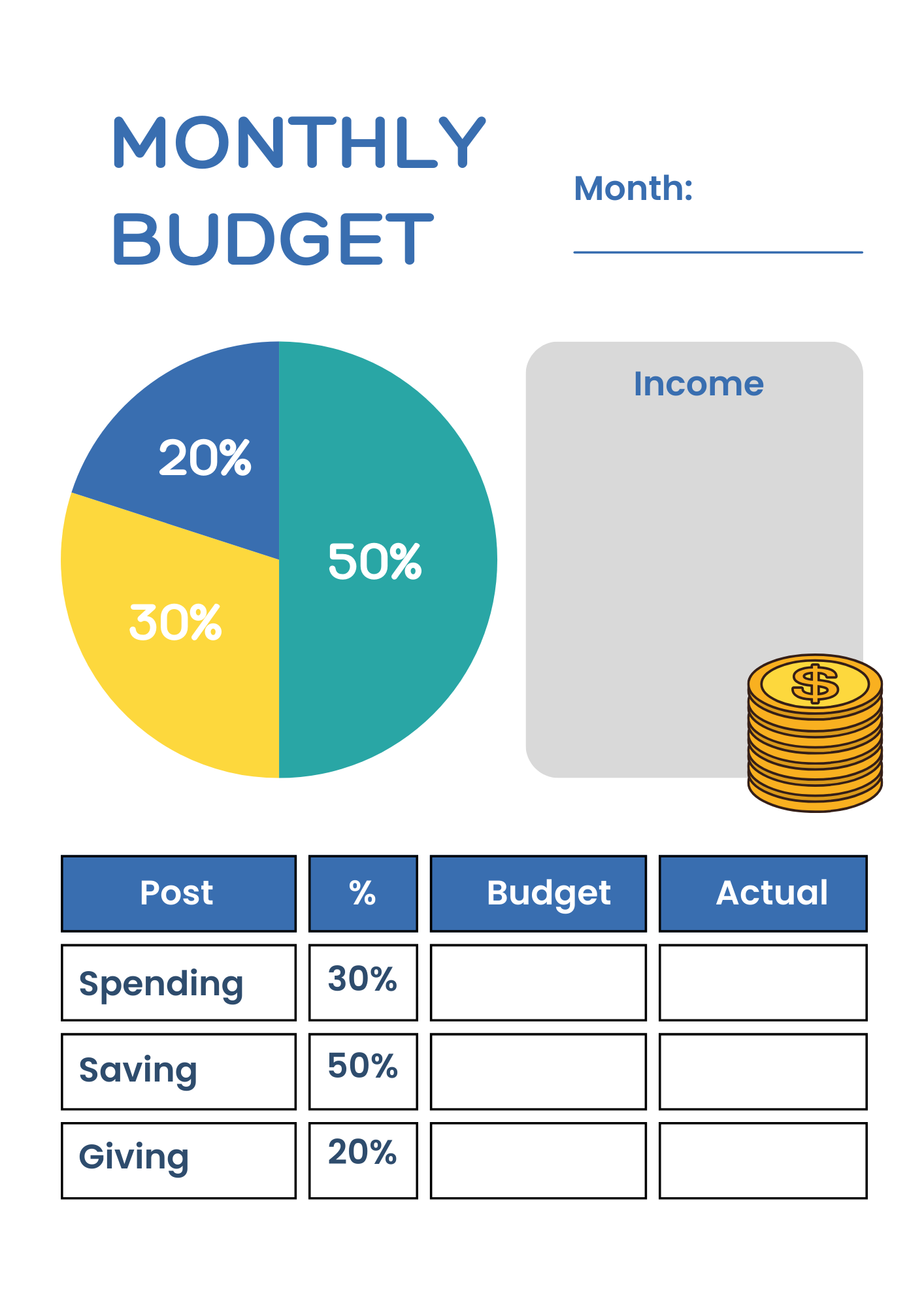

Practice the Spend, Invest/Save, Give Concept

Allocate your income into three categories: spending for necessities, investing/saving for the future, and giving to charitable causes. Download the budget planner here.

This balanced approach promotes financial health and social responsibility.

By incorporating these tips into your financial habits, you can build a stronger, more secure future for yourself and your kids. Another excellent way to prepare your children is through the Teenage Tycoon program, which I discovered at the conference. This mastermind program is designed for teens and their families to learn essential life skills such as finance, entrepreneurship, real estate, and investing. It includes weekly meetings and book clubs to support personal development and introduce kids to business owners and authors. We are excited to join and have our 11- and 13-year-olds participate in the Teenage Tycoon program as part of their homeschooling. If you're interested in joining us, you can learn more here.